38+ how do mortgage lenders verify income

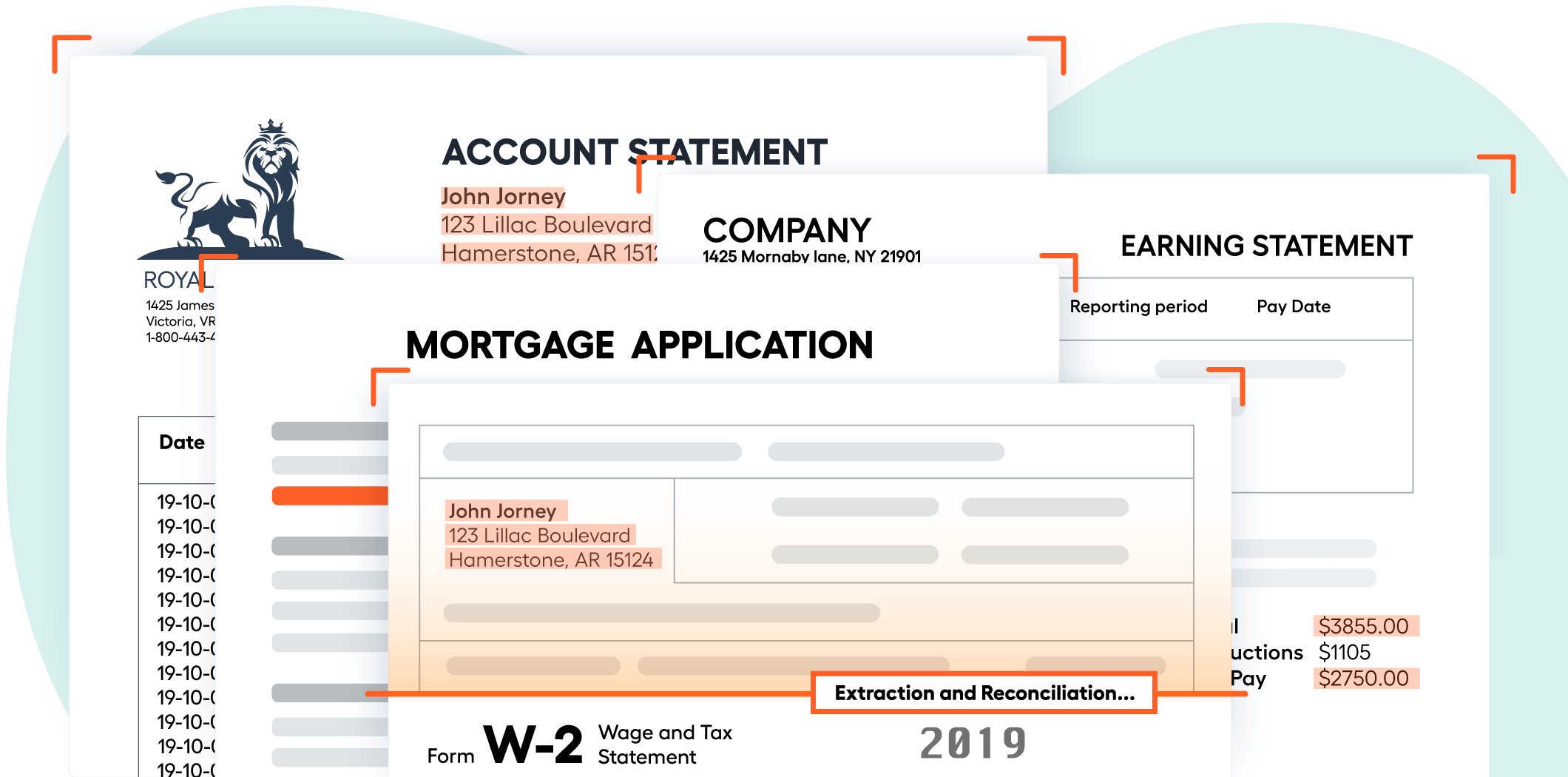

Your account number and type. Web To verify your income your mortgage lender will likely require a couple of recent paycheck stubs or their electronic equivalent and your most recent W-2 form.

.png?width=1050&height=600&name=AE%20landing%20page%20bottom%20Carousel%20(12).png)

Dscr Loans Visio Lending

Web If your retirement includes savings in an IRA 401 k or other retirement accounts you can use it as income to qualify for a mortgage.

. Web The bank statement verification process varies between lenders. Compare Mortgage Lenders And Find Out Which One Suits You Best. While they look at your income from any work additional income such as that.

Web Mortgage lenders prefer borrowers who have a stable predictable income to those who dont. Web A no-doc home loan program allows you to get a mortgage without tax returns that show declining income. They calculate your income by adding it up and dividing by 24 months.

Web 5 steps to get preapproved for a home loan. Compare Mortgage Lenders And Find Out Which One Suits You Best. Web The way mortgage lenders verify federal income tax returns is by requesting income tax return transcripts from the IRS through the IRS 4506T form.

Web Mortgage lenders and others within the financial community use the IRS Income Verification Express Service program IVES to confirm borrower income. Web When you are applying for a loan or looking to get pre-approved one of the things your lender will do is verify your income. Save Real Money Today.

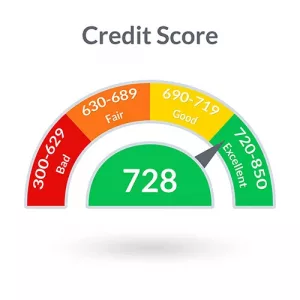

A credit score of at. We need to do this as part of our. Get your free credit score.

Web Mortgage lenders verify employment by contacting employers directly and requesting income information and related documentation. Save Time Money. The more streams of.

Web Mortgage lenders will want to verify that you have the means to pay the principal interest taxes and insurance PITI on your mortgage. You file multiple tax returns. Web The form breaks down the income by the type of income received by the borrower such as salary overtime commission and bonus.

Comparisons Trusted by 55000000. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Ad 5 Best Home Loan Lenders Compared Reviewed.

Web Many mortgage lenders rely on a debt-to-income DTI calculation to assess your ability to pay for a loan. 10 Best Mortgage Loans Lenders in Kansas Compared Reviewed. Its helpful to know where you stand before reaching out to a lender.

Comparisons Trusted by 55000000. Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online. Web How do mortgage companies calculate self employed income.

Youll need to prove. Web One step in the underwriting process is the verification of employment VOE. Web Therefore lenders require evidence that your income is stable and regular before approving your mortgage.

Most lenders only require verbal. When youre applying for a mortgage it sadly isnt as easy as just letting the lender know your annual salary. Since this is a handwritten.

The mortgage lender needs to check that you are and have been employed to. Web How do mortgage lenders verify your income. In addition since a.

Web To verify your income lenders are going to ask you for copies of your most recent pay stubs andor the W-2 and 1099 forms you submit when you file your tax. Most require a few basic types of information such as. To make sure this information is accurate most.

This calculation compares your monthly gross income typically from the. Apply Easily Save. Ad 5 Best Home Loan Lenders Compared Reviewed.

Ad Get Instantly Matched With Your Ideal Mortgage Lender. Web Tax documents give lenders information about your sources of income and possibly help them determine how much mortgage youre eligible for.

How To Apply For A Mortgage Zillow

How Do Mortgage Companies Verify Income

Free 10 Sample Mortgage Application Forms In Ms Word Pdf

Proof Of Income Apply For Your Home Loan With Altitude Today

Proof Of Income Apply For Your Home Loan With Altitude Today

How Do Lenders Verify Income Mortgage Specialists

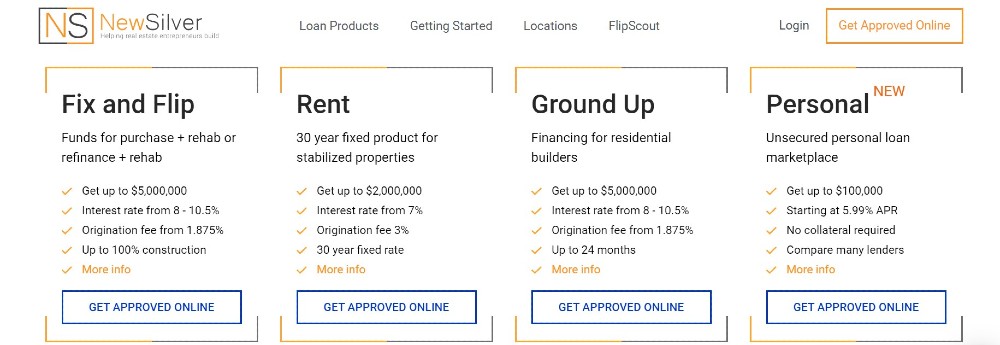

List Of Private Lenders For Real Estate New Silver

What Do Mortgage Lenders Require To Confirm Your Income Best Mortgage Broker Rates

No Doc Loans What They Are And How To Get One Credible

Mortgage Income Verification Requirements Credit Check Haysto

.png?width=1050&height=600&name=AE%20landing%20page%20bottom%20Carousel%20(8).png)

Dscr Loans Visio Lending

-1.png?width=1575&height=900&name=AE%20landing%20page%20bottom%20Carousel%20(10)-1.png)

Dscr Loans Visio Lending

Free 21 Employment Verification Letter Templates In Pdf Ms Word

Mortgage Document Verification Workfusion Use Case Navigator

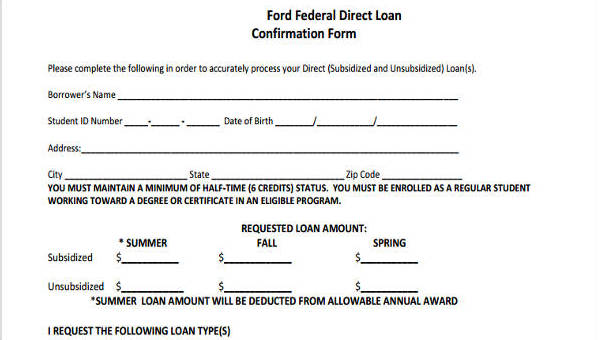

Free 8 Loan Confirmation Forms In Pdf

Income And Asset Verification A Guide Quicken Loans

Income Verification During The Mortgage Application Process